Bad Debts Written Off Journal Entry

When the company has enough evidence to write off the bad debt the accountant will seek approval from the management to write off the accounts receivable as bad debt. Here provision for bad debts for last year is given in trial balance is given.

Bad Debt Overview Example Bad Debt Expense Journal Entries

My Personal Notes arrow_drop_up.

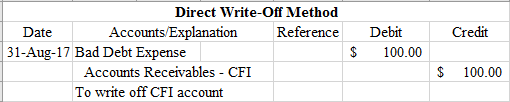

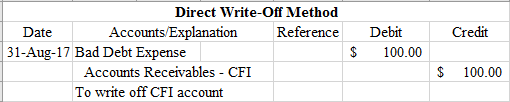

. Please provide the journal entries to be made for bad debt. A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense.

When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered. However on June 12 2021 Mr. In this case the company can make the journal entry of the written-off receivables under the direct write off method as below.

They record the uncollectible money as expenditure on company financial records whenever this occurs. Journal Entry for Bad Debts Written Off Written off means we are closing bad debt account by transferring bad debt amount to the debit side of our profit and loss account. However they are different.

Provision for bad debts Ac. New provision of 2 of 200000 which comes Rs 4000. Now as provision for bad debts 2 on debtors is to made.

42 related questions found. Loss on inventory write-off is an expense account on the income statement. Note that the provision for bad debts on 31122017 is Rs.

In this case we can make the journal entry for this 50000 bad debt written off on November 30 by debiting this 50000 amount into the allowance for doubtful accounts and crediting the same amount to the accounts. To record the claim of 700 GST as a bad debt relief you need to record using a payment transaction instead of a negative sales invoice Credit Note. You can apply for bad debt relief from the Comptroller of GST for return of the output tax previously accounted for and paid by you.

Journal entry to record the write- off of accounts receivable February 9 2018 April 12 2021 accta Q1 The entity concludes that 1200 of its accounts receivable cannot be collected in the future because the customer liquidated the business. Writing Off Bad Debts - Accounts Receivable. When an account receivable is reasonably expected to be uncollectible it is written off either directly or through a bad debts provision account in the period in which it becomes uncollectible.

When we will show bad debts in the debit side of profit and loss account bad debts account will show same amount in its credit side. A bad debt situation occurs when money that is owed cannot be recovered. A Payment transaction records the GST as an input tax whereas the GST in the sales transaction.

It is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible. It means we have to make new provision and also adjust it with old provision which is still with us. Note the absence of tax codes.

The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. The company can make the inventory write- off journal entry by debiting the loss on inventory write- off account and crediting the inventory account. If the business doesnt believe they could obtain the payments from the client it refers to as bad debt in this case.

Z that has a balance of USD 300. So both side of bad debt account. On the other hand if you as a customer have not paid your supplier within 12 months from the due date of payment you are required to repay to.

A sum of 2000 earlier written as bad debts is now recovered. D paid the 800 amount that the company had previously written off. Ms X should write off Rs.

An allowance of Rs. This expense has the same effect on profits as bad debts. Assume you have an old invoice of 10000 before 7 GST which you had written off as bad debt.

1000 from Ms KBC as bad debts. Bad debt is a category of accounts receivable AR which refers to the sum of cash that a client owes to a business. For example the company XYZ Ltd.

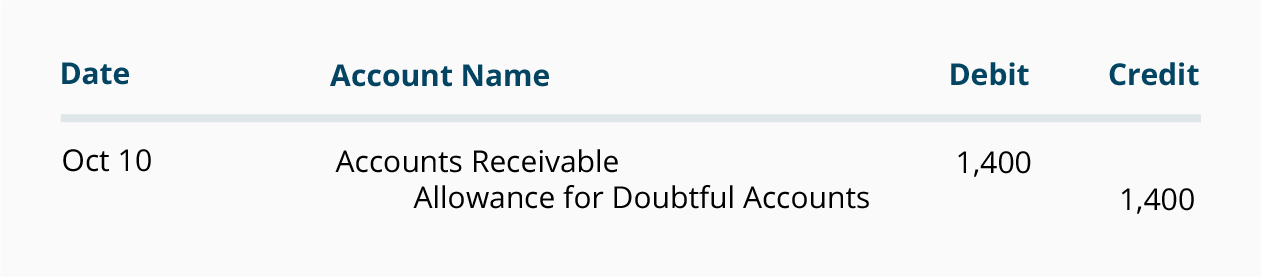

As mentioned companies create a doubtful debt expense that goes into the income statement. In this case the company ABC needs to make two journal entries for this bad debt recovery of Mr. Bad debts records the full write-off at.

After the journal entry is made Sales still records the sale at 35000. The balancing debit is to your bad debt expense account or your allowance for bad debts account if you are using that method. 1 day ago Bad Debts.

Otherwise a business will carry an inordinately. However the credit side is more complex. D by debiting the 800 into accounts receivable and crediting the same amount into the allowance for doubtful accounts in the first journal entry.

Create a journal entry to credit the amount of the unpaid invoice to your accounts receivable account. We use the allowance method to deal with bad debt so the net book value of their accounts on the balance sheet is already zero. The journal entries for written off bad debt under the provision for doubtful debt method are similar.

The entries shall be made as under-. February 04 2022. What is the journal entry for inventory write- off.

If the unpaid invoice includes an amount. The journal entry is debiting the 5000 to the bad debt expense account and crediting the same amount to the accounts receivable. Decides to write off accounts receivable of Mr.

To accurately write off bad debt for an invoice you must do the following. Since the tax is payable regardless of collection status the debt is written off with the following journal entry.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Change In Bad Debts Allowance And Subsequent Recovery Of Bad Debts Financiopedia

Writing Off An Account Under The Allowance Method Accountingcoach

0 Response to "Bad Debts Written Off Journal Entry"

Post a Comment